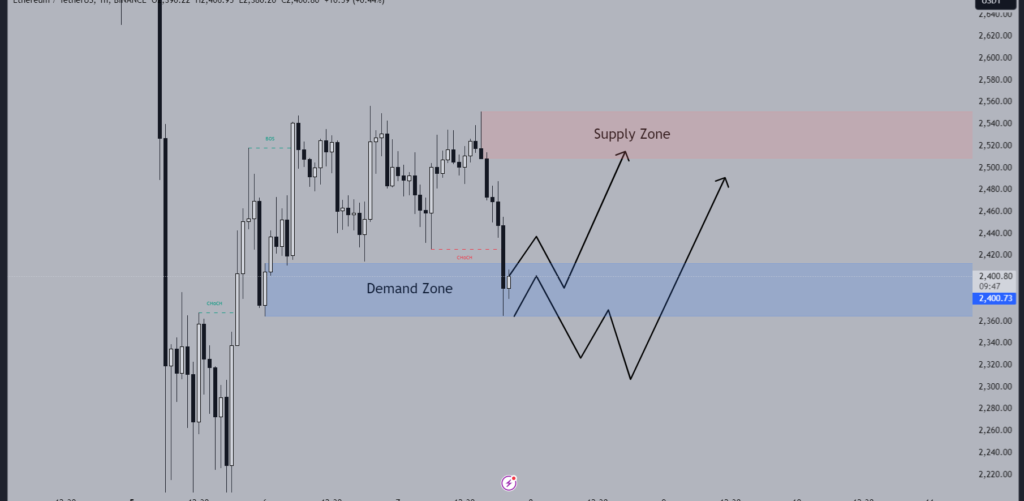

Ethereum (ETH) is making headlines today with its strong bullish signals, currently situated in a significant demand zone around $2,400 on the 1-hour timeframe. As traders and investors closely monitor its movement, the big question on everyone’s mind is whether Ethereum will cross the $2,600 mark today. Let’s dive into the analysis to understand the potential scenarios and market dynamics at play.

Current Market Overview

As of now, Ethereum is priced at $2,400.73, comfortably within a crucial demand zone ranging from $2,360 to $2,420. This zone has historically acted as a strong support level, providing a solid foundation for potential upward momentum.

Key Market Zones

- Demand Zone: $2,360 – $2,420

- Supply Zone: $2,520 – $2,560

Potential Scenarios

1. Direct Move to Supply Zone

One possible scenario is that Ethereum could make a straightforward upward move from the current demand zone directly towards the supply zone between $2,520 and $2,560. If this momentum continues, surpassing $2,560 and moving closer to $2,600 becomes a tangible possibility.

2. Seller Trap and Liquidity Use

Alternatively, Ethereum might experience a temporary dip, trapping sellers and using their positions as liquidity before making a significant push towards the 1-hour supply zone. This strategy can often precede a robust bullish run, propelling the price towards and potentially beyond the $2,600 mark.

Quick Analysis

The current outlook for Ethereum is notably bullish, with the demand zone around $2,400 offering strong support. Additionally, the growing speculation around the approval of an Ethereum ETF adds to the positive sentiment, enhancing the likelihood of substantial gains in the near term.

Factors to Watch

- Market Sentiment: Positive news and developments, such as the potential Ethereum ETF, can drive bullish momentum.

- Trading Volume: Increased trading volume, especially in the current demand zone, could indicate strong buying interest and support for upward movement.

- Macro Factors: Broader market trends and macroeconomic factors can also influence Ethereum’s price movement.

Key Takeaways

- Ethereum is in a crucial demand zone around $2,400.

- Potential upward movement towards the $2,520 – $2,560 supply zone is anticipated.

- Watch for a possible seller trap and liquidity use before the move.

- Market sentiment and trading volume will play pivotal roles in determining whether Ethereum can cross $2,600 today.

Conclusion

Ethereum’s current positioning in the demand zone and the overall bullish sentiment suggest a strong potential for upward movement. While crossing $2,600 today is not guaranteed, the conditions are favorable for a significant price increase. Traders should keep a close eye on market developments and trading volumes to make informed decisions.

Share your thoughts and opinions below, and stay tuned for more updates on Ethereum’s market trends. Happy trading! #Ethereum #CryptoAnalysis #EthereumETF